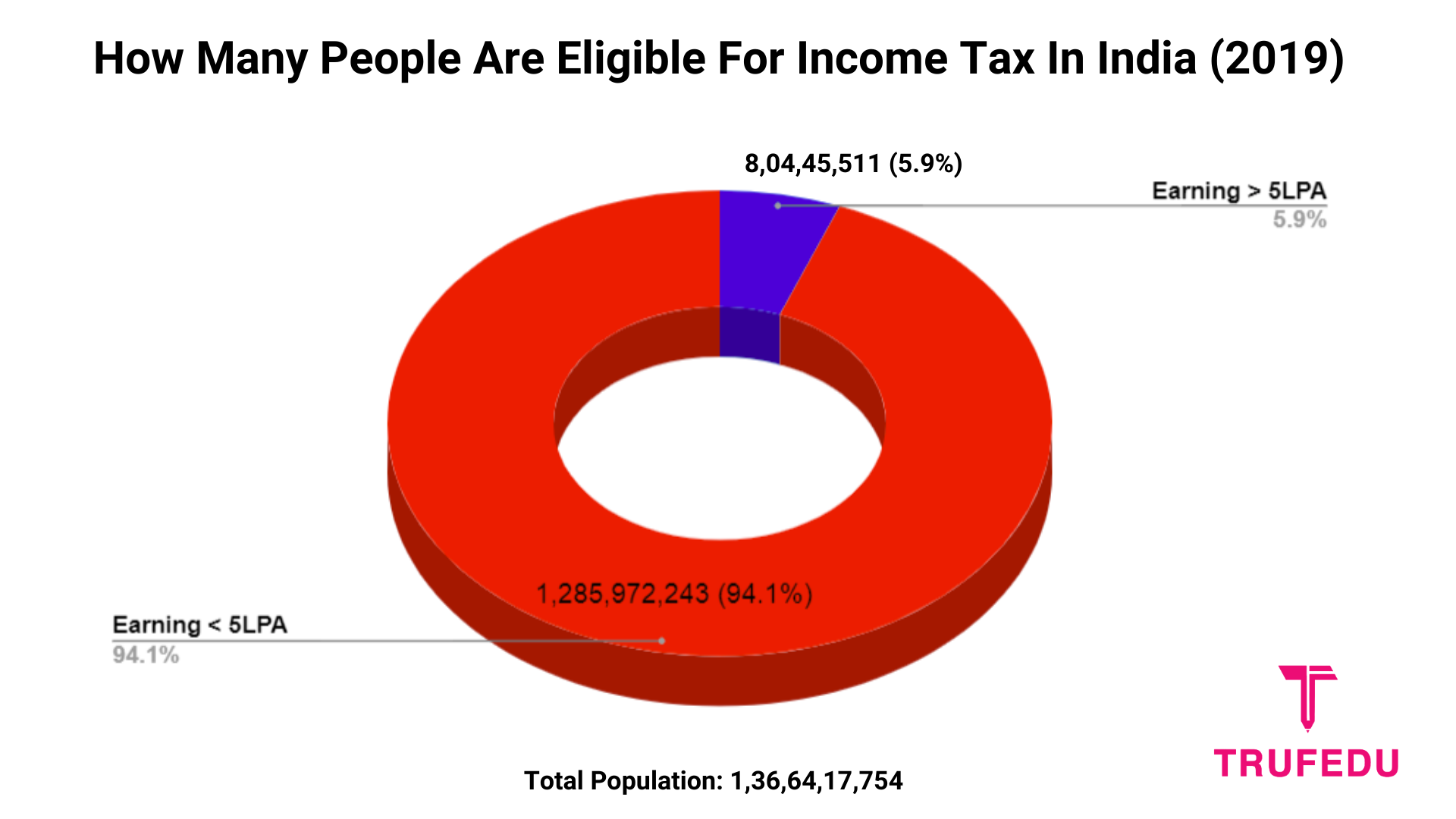

India despite being so highly populated and being one of the biggest economies in the world has a very small number of income taxpayers when compared to the population.

The taxpayer to population is increasing but still is in a single digit. WHY?

This isn’t due to the fact that people don’t show their income, the main 2 reasons for this are

- Tax Bracket in India

- Large numbers of people using cash as the main form of payment.

Let’s understand this in a bit more detail:

Tax Bracket

In India, if your taxable income is below 5 Lakh per annum, you don’t have to pay tax on it. As per the survey in 2019 per capita income of India is 1.35LPA which is way below the 5LPA.

So only a handful of people are earning above 5LPA.

Almost all other countries have their smallest tax bracket < the average per capita income which makes a lot more people eligible for paying income taxes.

For example, the USA’s smallest tax slab is 9700USD and the per capita income is 53480USD making the majority of people pay the tax.

Preferred Mode of Payment

India’s major mode of payment is cold hard cash. This makes a lot of money go ignored from the Income Tax Department, making their taxable income below the eligible bracket.